|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

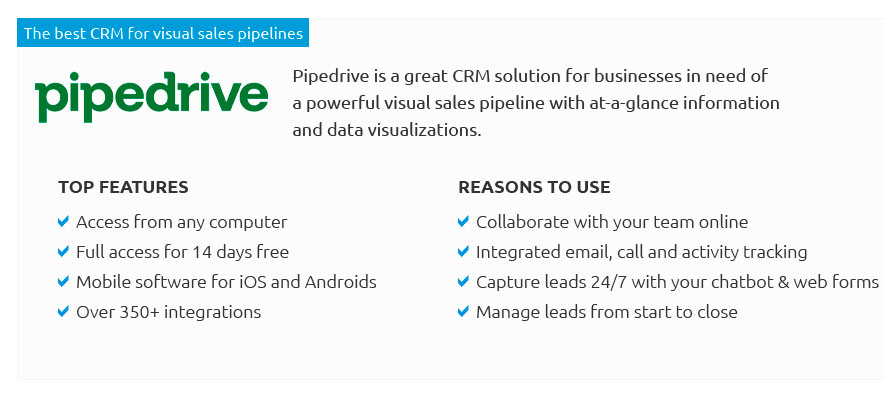

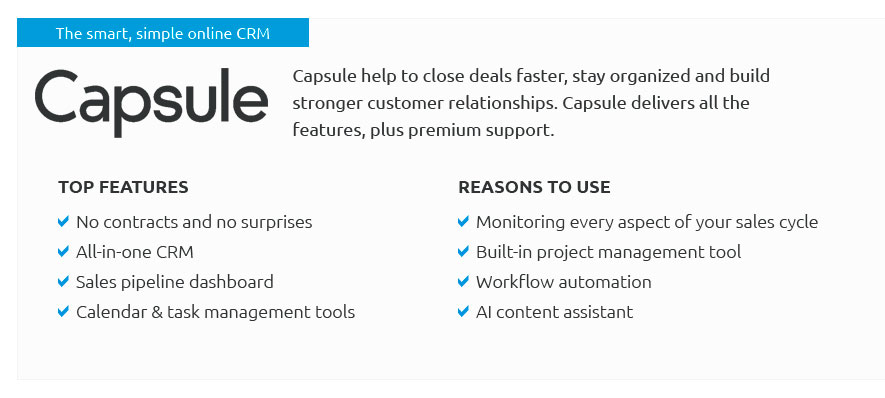

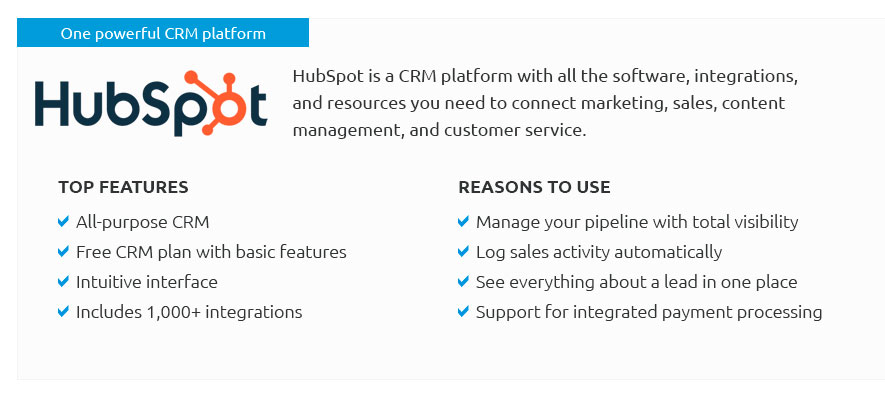

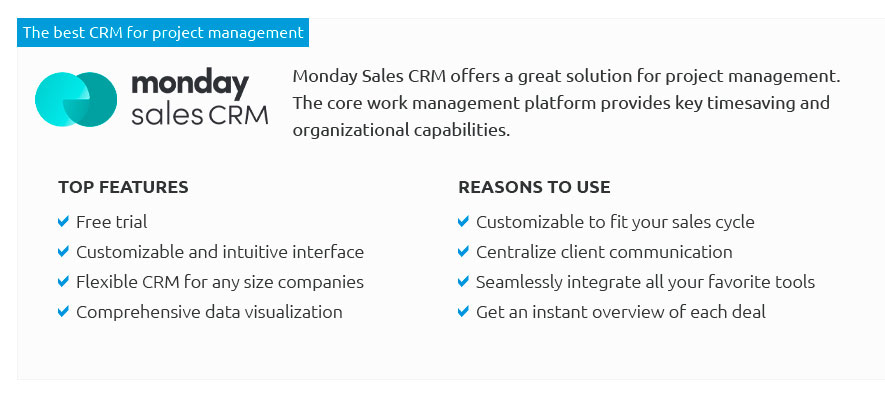

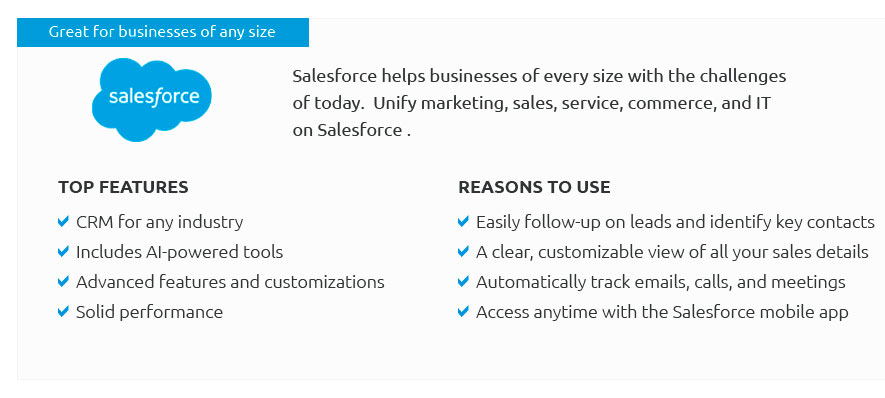

Choosing the Best CRM for a Small Financial Services FirmIn the ever-evolving landscape of financial services, small firms often find themselves grappling with the challenge of selecting a customer relationship management (CRM) system that not only meets their unique needs but also propels them toward greater efficiency and client satisfaction. The right CRM can serve as a cornerstone for managing client interactions, streamlining operations, and fostering growth. However, the plethora of options available can be overwhelming. This article delves into the quintessential attributes that define the best CRM for a small financial services firm, offering quick insights and subtle opinions to guide your decision-making process. First and foremost, a CRM should be intuitive and user-friendly. Small firms typically operate with lean teams, and an overly complex system can become more of a hindrance than a help. The ideal CRM should offer a seamless user experience, allowing team members to focus on building client relationships rather than wrestling with convoluted software. Additionally, integration capabilities are crucial. The ability to sync with existing tools, such as accounting software, email platforms, and data analytics programs, can significantly enhance productivity and data accuracy. Another critical factor to consider is scalability. As a firm grows, its CRM needs will inevitably evolve. Therefore, selecting a platform that can expand alongside your business, accommodating an increasing client base and more complex workflows, is essential. Furthermore, data security cannot be overstated. In the financial sector, safeguarding sensitive client information is paramount. A robust CRM should offer state-of-the-art security features, ensuring compliance with industry regulations and protecting against cyber threats. When it comes to specific CRM solutions, there are several contenders worthy of consideration.

In conclusion, selecting the best CRM for a small financial services firm requires careful consideration of factors such as usability, integration, scalability, and security. By evaluating these elements and exploring options like Salesforce, HubSpot, Zoho, and Wealthbox, firms can find a CRM solution that not only meets their current requirements but also supports their future growth. The right CRM can transform client interactions and operational efficiency, paving the way for sustained success in the competitive financial landscape. https://www.bigcontacts.com/blog/best-crm-for-financial-services/

BIGContacts Best for contact management & email marketing for small & medium businesses ... As a CRM expert, I can confidently say that ... https://smartasset.com/advisor-resources/choose-the-right-crm-for-your-advisory-practice

Redtail is the best CRM for financial advisors who want a software program that's easy to navigate. The interface is designed to be user- ... https://www.singlestoneconsulting.com/blog/top-7-finance-crms

The best CRM for financial services depends on the specific needs of the firm. Popular options include Salesforce Financial Services Cloud, Microsoft Dynamics ...

|